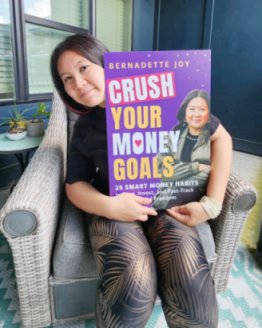

Couple Paid-off $300K Loan in Three Years

By: Lourdes G. Mon

When I read about Bernadette Joy Cruz Maulion and her husband Anthony (AJ) Maulion, I felt like I have missed some tremendous opportunities in my younger days. Here is the common progression for many Filipinos arriving in the United States in the 1980s and 90s. After a few years of earning the mighty dollar, it was common place to buy a home once a credit record is established. It’s a noble plan but where was Bernadette when I was younger and ambitious?

Bernadette was not even born when I started my career. If I had undergone her training, I may have been a millionaire to say the least. I am not complaining of how I became to be, but it’s still fun to build castles in the air. Bernadette Joy is a nationally recognized money expert featured on CNBC, MarketWatch, USA Today and TIME Magazine, and as a TV contributor for ABC’s Good Morning America, CBS’s The Doctors and Access Daily on NBC. She inspires her audience to explore the intersection between net worth and self-worth.

As first-generation Filipino Americans, Bernadette and husband AJ paid off a whopping $300,000 of debt in three years and grew their first $1 million of net worth in their thirties. Joy founded Crush Your Money Goals®, a six-figure financial education and media company that taught thousands across the US; to help those who are overlooked and underestimated by traditional financial services. Bernadette’s goal is to help others gain confidence in managing money and provide a blueprint to achieve financial independence.

Anthony (AJ) Maulion on the other hand, has a career in real estate, with luxury rentals in NYC and has gained a reputation for pursuing integrity, thoroughness, and an open, communicative relationship with his clients. From a career spanning over 12 years in business and leadership at General Electric and Duke Energy Corp., AJ applies his valuable experience in customer satBernadette Joy Maulion isfaction and quality culture to all of his interactions in NC real estate.

It’s fun to enumerate some simple and frugal money habits Bernadette practices even in the midst of her wealth. I wonder if she is an Ilokano like me? Ilokanos are known for being frugal.

1. She buys the least expensive cuts of meat.

She buys the cheapest pack of chicken thighs to save an extra 23 cents. She absolutely loves eating Korean barbecue, but beef short-ribs can be expensive. At her local international grocery store in Charlotte, North Carolina, the traditional cut is $11.99 per pound, but she buys the end-cuts that are only $7.99 per pound. She says, they aren’t as pretty, but since they have fewer bones, she finds them to be easier to prepare. They are delicious and ultimately better for her budget in the long run.

2. She saves her hotel room vanity kits.

She often travels for paid speaking engagements — and she is always excited when the hotel provides a complimentary vanity kit. The items in these kits can come handy in unexpected situations, especially if you’re on the go. Her favorites have been from her trips to Asia, where they often include toothbrushes, toothpastes and higher-than-expected quality combs and hair elastics. She uses the shower caps and hair elastics to organize her various electronics like spare chargers and converters. She repurposes those extra toothbrushes and toothpastes to clean her shoes when they’ve gotten dirty from long walking tours.

3. She repurposes her takeout food containers.

The takeout containers from restaurants nowadays are so much fancier than before. Instead of discarding the containers, she reuses them for her own storage purposes. They often come in various sizes and are sturdier than traditional plastic tubs, making them perfect for storing leftovers or organizing small items around the house. It’s also more environmentally friendly than tossing them after a single use.

4. She uses every drop of her favorite beauty products.

She is not embarrassed to say that she will be squeezing that toothpaste tube until she gets that very last dot. She says, “It may sound too frugal to some, but a lot of it stems from having grown up with eczema, a skin condition that has required me to spend tens of thousands of dollars on medications and specialized lotions. These products helped me avoid getting bullied as a kid, and now stop me from feeling self-conscious as an adult — especially as someone who speaks in front of large audiences. You can bet I will absolutely get my money’s worth out of that $30 bottle of lotion!”

5. She looks at the menu prices before she chooses her order.

She is proud to say that I’ve reached a new comfort level in my finances. But no matter how much she earns, when she is dining out, she reads what the dish costs first before she makes her decision about her meal. She says that many restaurants strategically place higher- price items at the beginning of the menu to catch your attention. So what she does is start at the end. By reading in reverse, she usually spots the more affordable options first.

6. She preserves high-quality shopping bags.

She has a collection of bags hidden underneath her kitchen sink. With her well-made, stylish and sturdy shopping bags, she makes sure she gets her moneys worth out of it! Those can serve as carriers for snacks, lunches or small items when she is on the go. She always keeps a disposable bag or two in her luggage when she travels.

7. She wears free T-shirts to the gym.

Because of the rise of the athleisure industry, sometimes going to the gym feels more like a fashion show than a fitness routine. Since she goes to several conferences and events a year that offer swag, she gladly wears those free T-shirts to her yoga dance classes instead of spending money on designer workout clothes. She also has lost way too many water bottles to feel good about buying an expensive one, so the free water bottles she gets in those gift bags suits her just fine, too.

Oh well, even at my age, I am proud and love reading about the successes of young Filipino Americans. More power and wealth to Bernadette Joy and AJ. I recommend to young people to read Bernadette’s book, “Crush Your Money Goals.”

Bernadette Joy Maulion