By: Jan Paul C. Ferrer

Studies have shown that trying to time market entries and exits rarely pays off and may, in fact, lead to investment losses.

Market timing seems so easy, in theory. Buy when prices are low and sell when they are at a high. Anyone who diligently follows the market and stays abreast of economic news can anticipate, and capitalize of these movements, right?

Wrong, at least not over the long term. As history has shown repeatedly, market timing is a losing game. Volumes of research critical of the practice have been written, and some of the greatest investment minds – William Sharpe, a Nobel laureate, Benjamin Graham, considered the father of value investing and John Bogle, founder of The Vanguard Group – have all counseled against it.

Experts are right a fraction of the time. Even so-called market timing experts can’t consistently predict when to move in and out of the market. A study by CXO Advisory Group tracked more than 4,500 forecasts by 28 self-described market timers, between 2000 and 2012. Only 10 were able to accurately forecast equity returns (as measured by the S&P 500®) over 50% of the time, and none were able to predict accurately enough to outperform the market.1

Certainly, some investors have made accurate market calls, and others have predicted a market bottom or top. But over the long run, the law of averages usually wins out, effectively rendering a market timing strategy a game of chance.

As difficult as market timing is for professional investors, they are typically guided by a buy and sell discipline. Nonprofessional, individual investors tend to sell in a panic at or near a bottom, and buy in a flush of confidence at or close to a market top. Behaviors such as loss aversion, overconfidence, anchoring and avoidance often overtake rational decision making, resulting in losses.

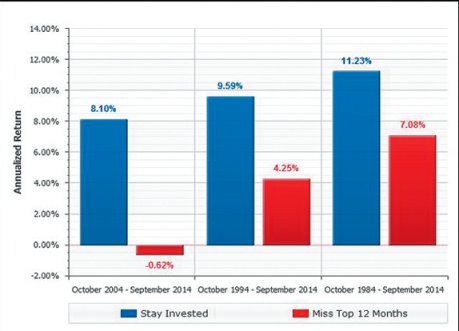

Perhaps the most significant deterrent to market timing is the cost of being out of the market. For example, the chart that follows shows the effect of missing the 12 top-performing months for stocks (as measured by the S&P 500®) during the 10-, 20-, and 30-year periods ended September 30, 2014. Investors who remained invested for the entire period would have achieved higher returns for each holding period than those who tried to time the market and missed.2

The Effect of Missing Top Performance Periods for Stocks, Past 30 Years

So if you are considering a market timing strategy, think again. There are other choices, such as tactical asset allocation, that may allow you to take advantage of market opportunities, yet remain fully, or substantially invested. Let me work with you to pursue a strategy that suits your unique needs and long-term goals.

Footnotes/Disclaimers 1Index Fund Advisors, Inc. (IFA.com), 2014. Based on a study by CXO Advisory, copyright: CXO Advisory Group LLC. http://www.ifa.com/12steps/step4. 2Source: Wealth Management Systems Inc. For the period from October 1, 1984, through September 30, 2014. Based on the total returns of the S&P 500® index. Copyright © 2015, Wealth Management Systems Inc. All rights reserved. Not responsible for any errors or omissions.

The S&P 500® is a market- value-weighted index of 500 large capitalization stocks traded on the NYSE, AMEX and NASDAQ. Past performance is not a guarantee of future results. For illustrative purposes only and does not reflect any specific product. Index returns assume reinvestment of dividends and do not reflect any fees or expenses. Indexes are unmanaged and it is not possible to invest directly in an index.

If you’d like to learn more, please contact Jan Paul C. Ferrer.

Article by Wealth Management Systems Inc. and provided courtesy of Morgan Stanley Financial Advisor.

The author(s) are not employees of Morgan Stanley Smith Barney LLC (“Morgan Stanley”). The opinions expressed by the authors are solely their own and do not necessarily reflect those of Morgan Stanley. The information and data in the article or publication has been obtained from sources outside of Morgan Stanley and Morgan Stanley makes no representations or guarantees as to the accuracy or completeness of information or data from sources outside of Morgan Stanley. Neither the information provided nor any opinion expressed constitutes a solicitation by Morgan Stanley with respect to the purchase or sale of any security, investment, strategy or product that may be mentioned.

Morgan Stanley Financial Advisor(s) engaged Via Times to feature this article.

[Jan Paul Ferrer may only transact business in states where he is registered or excluded or exempted from registration [http://www.morganstanleyfa.com/fe rrer. Transacting business, followup and individualized responses involving either effecting or attempting to effect transactions in securities, or the rendering of personalized investment advice for compensation, will not be made to persons in states where Jan Paul Ferrer is not registered or excluded or exempt from registration. © 2015 Morgan Stanley Smith Barney LLC. Member SIPC. CRC 1186975 [05/15

VIA Times – September 2015 Issue Vital News, Vibrant Views for Asian Americans in Chicago & Midwest

VIA Times – September 2015 Issue Vital News, Vibrant Views for Asian Americans in Chicago & Midwest